Exploring the Evolving Landscape of Thailand's Insurtech and Insurance Market in 2023

Thailand, a country renowned for its vibrant tourism industry, rich cultural heritage, and emerging markets, has faced numerous economic challenges in recent years. As we set our sights on the third quarter of the year 2023, it is vital to address the lingering obstacles that may hinder Thailand's economic growth and development.

In recent years, the Thai government has actively worked towards enhancing the insurance sector, implementing a range of plans dedicated to its development. One pivotal aspect of this initiative centers on the systematic enhancement of insurance regulation and oversight. Over the past seven years, significant advancements have been made across multiple facets of supervision.

Economic Challenges and Opportunities in Thailand 2023

The World Bank's semi-annual Thailand Economic Monitor forecasts a significant uptick in Thailand's economy, with growth expected to surge to 3.9 percent in 2023 from the previous year's 2.6 percent. This remarkable growth is attributed to robust demand from major global players like China, Europe, and the United States, along with expanding private consumption. Furthermore, the revival of international tourism, which plays a pivotal role in the Thai economy, particularly during the first half of 2023, underscores the tourism sector's pivotal role as a primary driver of growth for the year.

Steady Growth

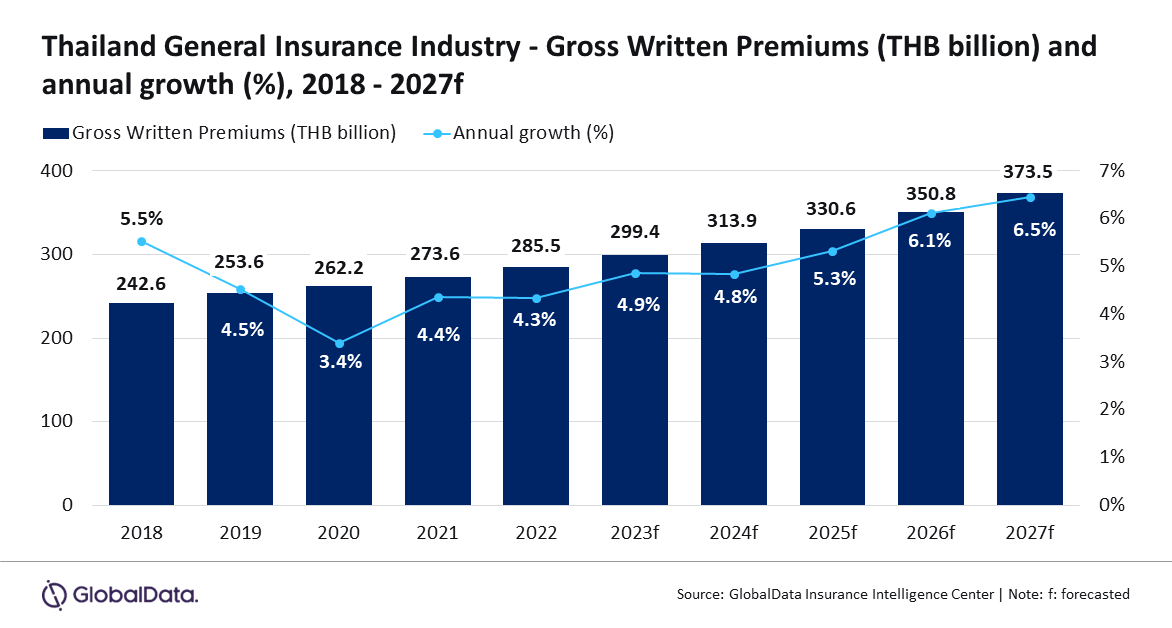

The general insurance sector in Thailand is poised for consistent expansion in the coming years, projected to reach $11 billion (THB 373.5 billion) by 2027, supported by a compound annual growth rate (CAGR) of 5.7%.

According to insights from data analytics firm GlobalData, the sector is anticipated to crest at $8.1 billion (THB 285.5 billion) during the current year. It is expected to exhibit growth rates of 4.9% in 2023 and 4.8% in 2024. These positive trends can be attributed to factors such as a resurgence in vehicle sales, government-backed infrastructure projects, and a rising demand for natural catastrophe insurance.

Thailand has been experiencing a continuous rise in income levels and economic development throughout the years. This economic growth often leads to an increase in consumer spending and disposable income, which can positively impact the demand for insurance products. Furthermore, as the population becomes more aware of the importance of insurance coverage and the need to protect their assets, this could also contribute to the potential growth of the insurance sector in Thailand.

Additionally, the Thai government has been implementing policies to encourage the growth of the insurance industry and increase insurance penetration within the country. Measures such as promoting insurance education, enhancing consumer protection, and expanding insurance coverage in sectors such as healthcare and agriculture could further drive the growth of insurance in Thailand.

Emerging Technologies

The insurance industry is undergoing a significant transformation globally, with technology playing a pivotal role. As we look ahead to the year 2024, it is essential to assess the outlook for insurance technology in Thailand, a country that is experiencing rapid digital adoption and economic growth.

Thailand's insurance sector has traditionally been perceived as conservative and slow in embracing technological advancements. However, in recent years, there has been a noticeable shift towards digitization as insurers recognize the potential benefits that technology can offer in terms of efficiency, customer experience, and risk management. This trend is expected to accelerate over the next few years, making Thailand a fertile ground for insurance technology (insurtech) development.

Additionally, the increasing usage of smartphones and internet penetration among the Thai population will play a critical role in shaping the insurtech landscape. According to Statista, the number of smartphone users in Thailand is projected to reach over 58 million by 2023, accounting for nearly 84% of the population. This unprecedented connectivity will create opportunities for insurtech companies to provide innovative, mobile-based solutions that cater to the needs of tech-savvy consumers.

However, despite the positive outlook, there are challenges that need to be considered. One major hurdle is the regulatory environment. As insurtech disrupts traditional insurance models, regulators will need to strike a balance between promoting innovation and protecting consumers' interests. This requires the establishment of a robust regulatory framework that provides clarity and supervision without stifling innovation.

In 2024, we can expect the insurtech landscape in Thailand to be vibrant and dynamic, driven by several key factors. Firstly, the government's commitment to fostering a digital economy is likely to incentivize insurtech startups and encourage innovation in the sector. With initiatives such as the Thailand 4.0 vision and the Eastern Economic Corridor (EEC) project, the country is actively promoting the adoption of technologies like artificial intelligence (AI), blockchain, and Internet of Things (IoT) in various industries, including insurance.

)

)