Leveraging Digital Platforms to Bridge Insurance Gaps in Southeast Asia

Since the onset of the COVID-19 pandemic, over 70 million individuals in SEA have transitioned to digital consumption patterns, catalyzing a profound change in the insurance landscape. While traditional insurance models persist, the emergence of digital platforms has paved the way for novel approaches to coverage. Notably, microinsurance has emerged as a frontrunner in promoting financial inclusion, leveraging its affordability and flexibility to cater to previously underserved segments of the population.

In this era of digitalization, the concept of Insurance-as-a-Service (IaaS) has gained traction, offering insurers the tools to scale, personalize, and embed insurance seamlessly into consumers' lifestyles. HIVE by Income stands at the forefront of this movement, facilitating Insurtech integrations and minimizing development costs. Through case studies like SNACK and JupViec Care, the tangible impact of such innovations becomes evident, underscoring the potential to cater to diverse consumer needs with speed and efficiency.

In this article, we had the privilege of interviewing Peter Tay, who serves as the Chief Digital Officer at Income Insurance.

1. What role do you see digital insurance playing in closing protection gaps for underserved segments in APAC, particularly in Southeast Asia, as we move further into 2024? How do you use technology or insurance innovations to address these protection gaps?

We define “underserved segments” as customer segments who have substantial essential insurance protection gaps and have not been served through conventional touchpoints or propositions. For example, gig or platform workers, first jobbers, or domestic helpers, who may face variable income streams and do not resonate with lump-sum insurance premiums.

For this segment of customers, microinsurance resonates with them as they offer a low barrier of entry. Regionally, we play the role of an InsurTech as we extend our Insurance-as-a-Service (IaaS) model, through HIVE by Income, which is a middleware platform that connects like-minded insurers to innovative and tailored digital propositions that they can bring to their markets with speed and cost efficiencies.

One such proposition that has gained regional traction is stackable insurance which helps customers builds substantial sum-assured in life, health, and general insurance. Customers resonate with the proposition because it is low cost, embedded in their daily lives and offers flexibility to start and stop the insurance according to their circumstances.

For example, we launched Critical Illness: Pay Per Trip (CIPPT) in Singapore with GrabInsure. This stackable insurance proposition enables Grab driver-partners to purchase critical illness protection by paying between S$0.10 and S$0.50 in premium for a commensurate sum assured and accumulate corresponding coverage for each complete trip. This proposition, which allows drivers to start and stop their insurance stacking anytime is a significant and viable option given that drivers’ cash flow is often variable. To date since its launch in 2019, CIPPT has issued 26,939,006 policies and paid out $1,792,873.90 in claims.

2. With the increasing adoption of insurance-as-a-service (IaaS), how do you envision the evolution of traditional insurance models to meet the needs of digitally savvy consumers in APAC? How does this augment your regional expansion strategy?

It is important to understand the psyche of digitally savvy consumers if we aim to resonate with them, support their insurance needs and close their protection gaps. Consumers who are digital-first today are used to a myriad of options and making decisions at their fingertips as they go about their daily lives. Convenience, cost-effective, ease of use and integrated into their lifestyles are what resonate with them and influence their decisions.

Thus, traditional insurance models will need to evolve and keep instep with digital-first customers in this regard and think beyond traditional touchpoints and conventional partnerships such as banks and brokers. Through IaaS offered by HIVE by Income, traditional insurers can have access to digital lifestyle partnerships that never existed before. For example, through IaaS, it is possible now to work with a café to issue loyalty points in the form of micro-insurances to build customers’ affinity to the café and insurer. Today, Income Insurance is working with over a hundred lifestyle partners to issue micro-insurances or investments as a novel way to rewards partners’ customers.

Regionally, we have been supporting financial service companies who are excited about such untapped partnerships to help them win new customers and to retain existing ones.

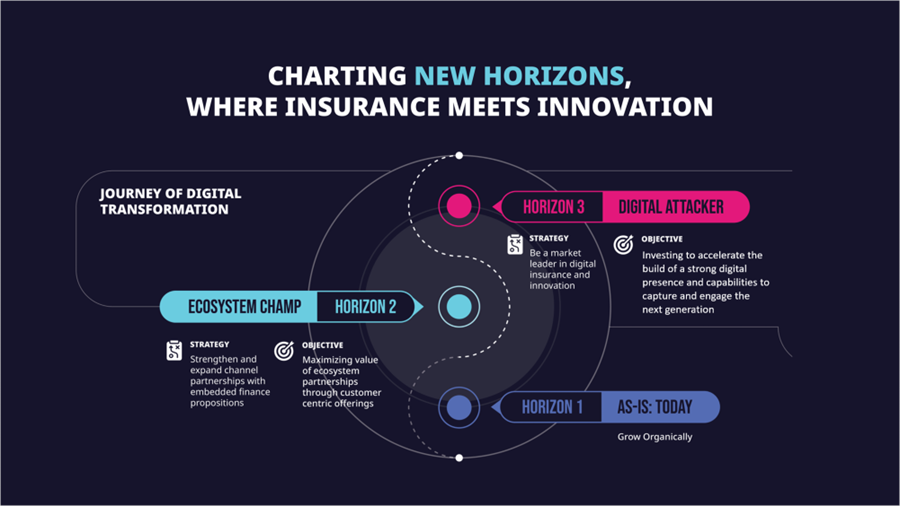

Through HIVE, we help financial service providers, such as insurers, break through their traditional business model and become an ecosystem champion where they integrate their financial offering and services into consumer-facing digital platforms to support wider market engagement.

By leveraging our highly modularized digital propositions, HIVE allows partners to retrofit products so that they can seamlessly plug into existing digital ecosystems easily.

One example is TPBank PA+, a product that allows TB Bank customers to accumulate insurance coverage through regular banking transactions. Launched in October 2023, the product saw a surge in weekly active user engagement by over 80% within the first two months. Buoyed by this success, TPBank introduced a second, complementary product focused on critical illness coverage, TPBank CI+.

For HIVE partners who are more ambitious, we support their transformation into a digital attacker by leveraging our technology to create new markets and insurance innovations that disrupt traditional insurance practices. By tapping into HIVE’s insurtech capabilities, partners can accelerate their growth without reinventing the wheel. Our full tech stack allows partners to build their own digital platform, such as launching front-facing apps like SNACK, or building relationships directly with their customers.

3. How do you foresee the integration of insurance into everyday activities and services evolving in APAC, and what impact do you anticipate this having on overall insurance penetration?

The future of insurance distribution lies in integrating insurance in everyday activities as we reach them amidst their digital lifestyle where it’s most intuitive for them to engage with us.

With the rise of digitalisation and digital-first customers, we foresaw that lifestyle-embedded insurance propositions will catch on and hence, have been taking inspiration from customers’ lifestyle and related insights to inform our considerations for insurance innovations and ideations. The SNACK proposition is a case in point, and our ongoing partnerships with VISA and Mastercard demonstrate our commitment to leveraging customer insights to serve our customers better.

Two types of digital propositions hold great potential in integrating into the daily lives of digital-first customers and they are namely, embedded insurance and stackable insurance. Embedded insurance is a seamlessly integrated solution that cross-sells relevant insurance protection in an online non-insurance customer journey, providing an opportunity for insurers to penetrate into different markets while mutually benefiting businesses by integrating insurance in the sales and purchase loop. For example, customers who sign up for a Trust Bank account can purchase in the same journey a subscription-based insurance, and online shoppers can purchase freightsurance that we offer as they cart out.

For stackable insurance which allows users to accumulate insurance coverage of a sum assured via micro-premiums that are as low as a few cents, our SNACK and CIPPT propositions are examples.

According to McKinsey, Asian insurers are well positioned to capture the market in embedded insurance, and by 2030, embedded insurance in Asia is expected to grow to become a $270 billion market in terms of GWP. Such vast potential is bound to attract more innovative insurance propositions which is a boon for customers and with HIVE, we are glad to be ahead of the curve.

4. How has cloud allowed you to go to market quickly and giving you a competitive advantage?

Due to its agility and scalability, cloud enables HIVE by Income to deploy in multiple countries concurrently, greatly reducing our regional partners’ time to integrate into our modular offerings and achieving speed to market and capturing new customer segments. Through this way, we have successfully embedded insurance offerings, varying from stackable to usage-based insurance, in purchase journeys on digital banks and e-wallets. The TP Bank example is a case in point.

5. In light of the rapid digitalisation across sectors catalysed by the pandemic, how has the landscape of digital insurance transformed over the past two years, and what initiatives is your organisation undertaking to further drive innovation and accessibility in this space?

We have evolved from Insurance 2.0, which is defined by increasing disintermediation and heightened customer-centricity, to Insurance 3.0. Understanding where data and automation are leveraged to support new insurance innovations, and what it entails in Insurance 3.0, is key to our success. Insurance 3.0 is all the demands of 2.0 compounded by a deeper and strategic use of technologies that streamline and automate insurance offerings and services that are based on hyper-personalised insights of customers.

The rise of new technologies – IoT, blockchain, AI – and their applications in insurance are enabling insurers to gain access to massive real-time data to accurately predict potential risks/losses and alert customers accordingly before they occur to reduce impact on claims and premiums. These new technologies can shift insurance from “detect and repair” to “predict and prevent” (core risk mitigation role of insurance), e.g., tech on car dashboard to inform driver of increased risk if they choose certain routes, drive in certain behaviour, certain time of day or weather conditions.

Generative AI is also holding much potential. We have been piloting use cases to explore its potential to drive operational excellence and business efficiency. For example, we have leveraged AI to redesign customer segmentation and proprietary cross-sell and campaign management, leading to substantial financial savings, while reducing turnaround time by 50% and enhanced productivity by about 20%. We have also leveraged AI to process over 11 million customer transactions, enabling us to analyse customers’ behavioural data to support risk assessment and feasibility testing of insurance innovations.

However, to truly succeed in today’s complex environment, we must also ensure data transparency and security. Customers must be open and confident to share information, while companies must maintain trust and license to operate. More specifically, we have developed clear data protection protocol, cyber security measures, and embedded a risk-aware culture at the company, leveraging on staff as defence ecosystem.

We also recognise an increasing need for rules of engagement regarding data ownership, accountability, traceability, and use, especially within an ecosystem/partnership play to safeguard the wider use of open-source data from connected devices as we gain more nuanced insights into customers. This is important as regulation may potentially disrupt decentralised usage of data insights if accountability and trust are compromised. To meet regulatory requirements, we work with Amazon Web Services for data analytics to ensure that our use of data is safeguarded.

We are also aware of people risk due to the knowledge gap. Hence, we see it as fundamental for us to staff people with knowledge of new technology, data science and advanced analytics to provide effective oversight and challenge the risks introduced by such technologies. We are also investing in the relevant training of our staff (16 hours of training annually) and to hire and keep a diverse team, to achieve an outside-in view while we leverage diverse knowledge and perspectives. I believe in managing collisions to bring about beautiful outcomes.

)

)