Revolutionizing the Philippines Insurance Sector: An Insight into the Growing Insurtech Market

The Current Landscape of the Philippines Insurance Market

The Philippines insurance market in 2023 is demonstrating a positive outlook, driven by various factors such as strong economic growth, increasing demand for insurance products, and the construction of new infrastructure projects. According to a market research report by Ken Research, the non-life insurance segment is expected to witness substantial growth, primarily due to rising awareness about insurance products and an increase in disposable income among the population. Additionally, the life insurance sector is projected to experience steady growth, fueled by the growing demand for protection and investment-linked insurance plans.

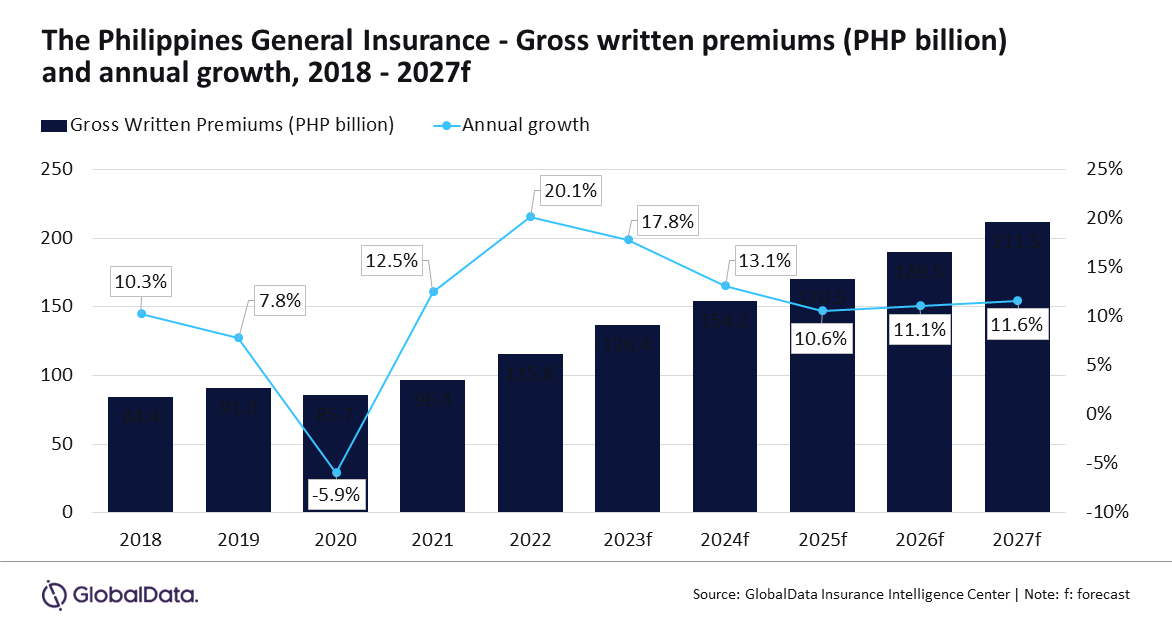

Another study by GlobalData predicts that the Philippines insurance market will grow at a compound annual growth rate of 6.2% between 2021 and 2024, indicating its resilience and potential for expansion.

These forecasts highlight the positive trajectory of the insurance market in 2024, showcasing opportunities for innovation, customer-centric strategies, and increased insurance penetration in the country.

Understanding the Role of Insurtech in Transforming the Industry

In recent years, the Philippines has witnessed a significant transformation in the insurance industry, with Insurtech playing a pivotal role in driving change. Insurtech, the innovative intersection of technology and insurance, has allowed for improved efficiency and customer experience, while also opening up new avenues for growth within the sector.

According to a study by Deloitte (2019), Insurtech has resulted in reduced operational costs and advanced product customization in the Philippine insurance market. In addition, the Bangko Sentral ng Pilipinas (BSP) noted that embracing technological advancements, such as digital platforms, has enabled key industry participants to cater to a broader customer base in under-served regions of the country. Through these innovations, Insurtech is revolutionizing the Philippine insurance landscape, resulting in increased financial inclusion and accessibility for the nation's population, while also enhancing the overall competitive landscape of the industry.

Key Drivers of Insurtech Adoption in the Philippines

Insurtech adoption in the Philippines has been primarily driven by key factors such as increasing digital penetration, the need for simplified insurance processes, and a strong regulatory support system. The rise in internet and smartphone usage has made it feasible for insurance firms to reach a wider consumer base digitally.

For instance, initiatives by companies like Igloo aim to offer granular insurance coverage through its distribution platform partners, enhancing the reach and accessibility of insurance services. Furthermore, the simplification of insurance processes through technology, as observed in the case of AXA Philippines, paves the way for more efficient and appealing services. Lastly, a supportive regulatory framework further facilitates insurtech adoption. Indeed, regulators in the Philippines have shown receptivity to the introduction of fintech products and services.

Morever, insurtech is seen to enhance insurance penetration through the offerings of microinsurance products via online channels. The government also plays a key role in supporting this growth, with agencies like the Philippine Insurance Commission promoting technological innovations within the sector.

)

)